Finance

Finance

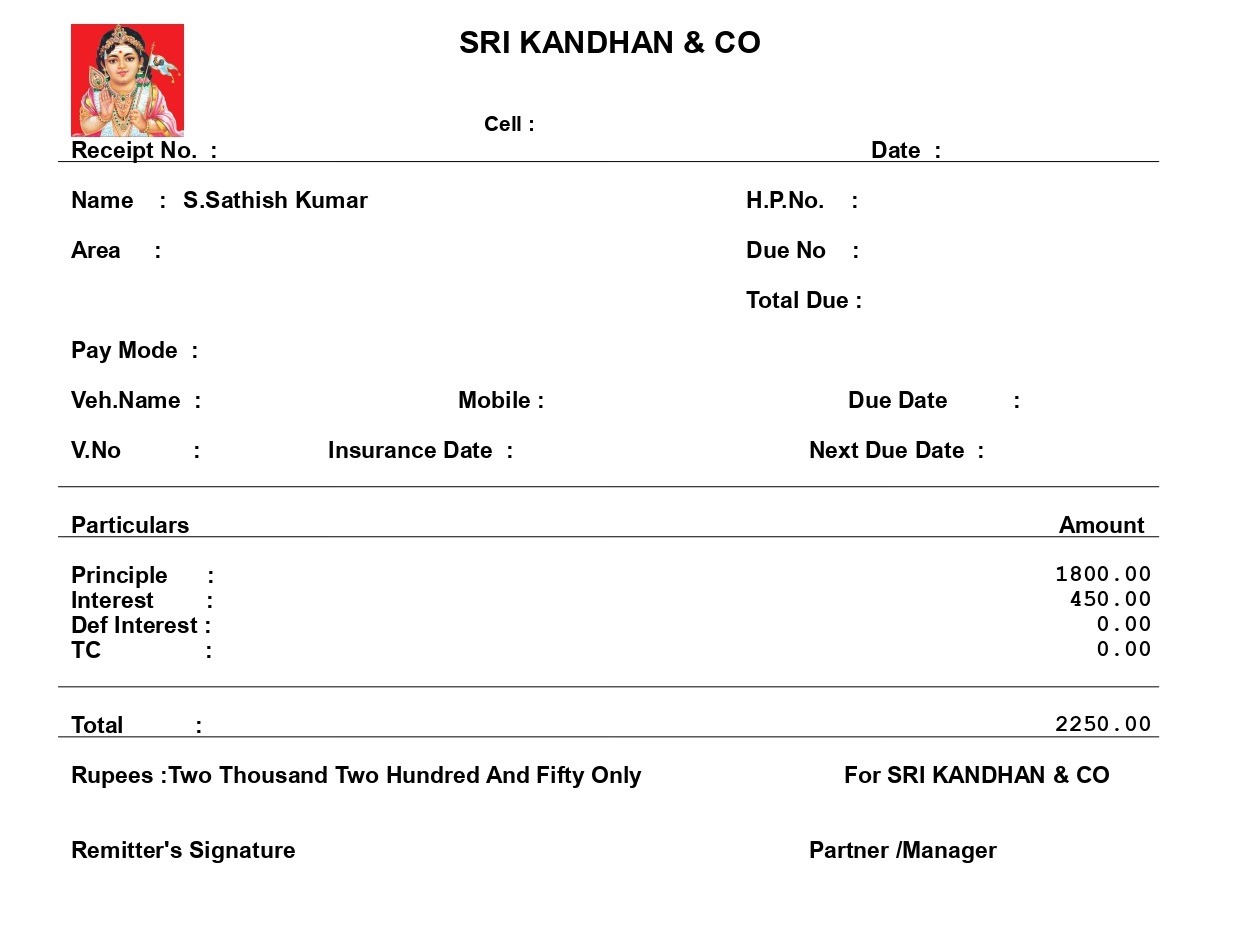

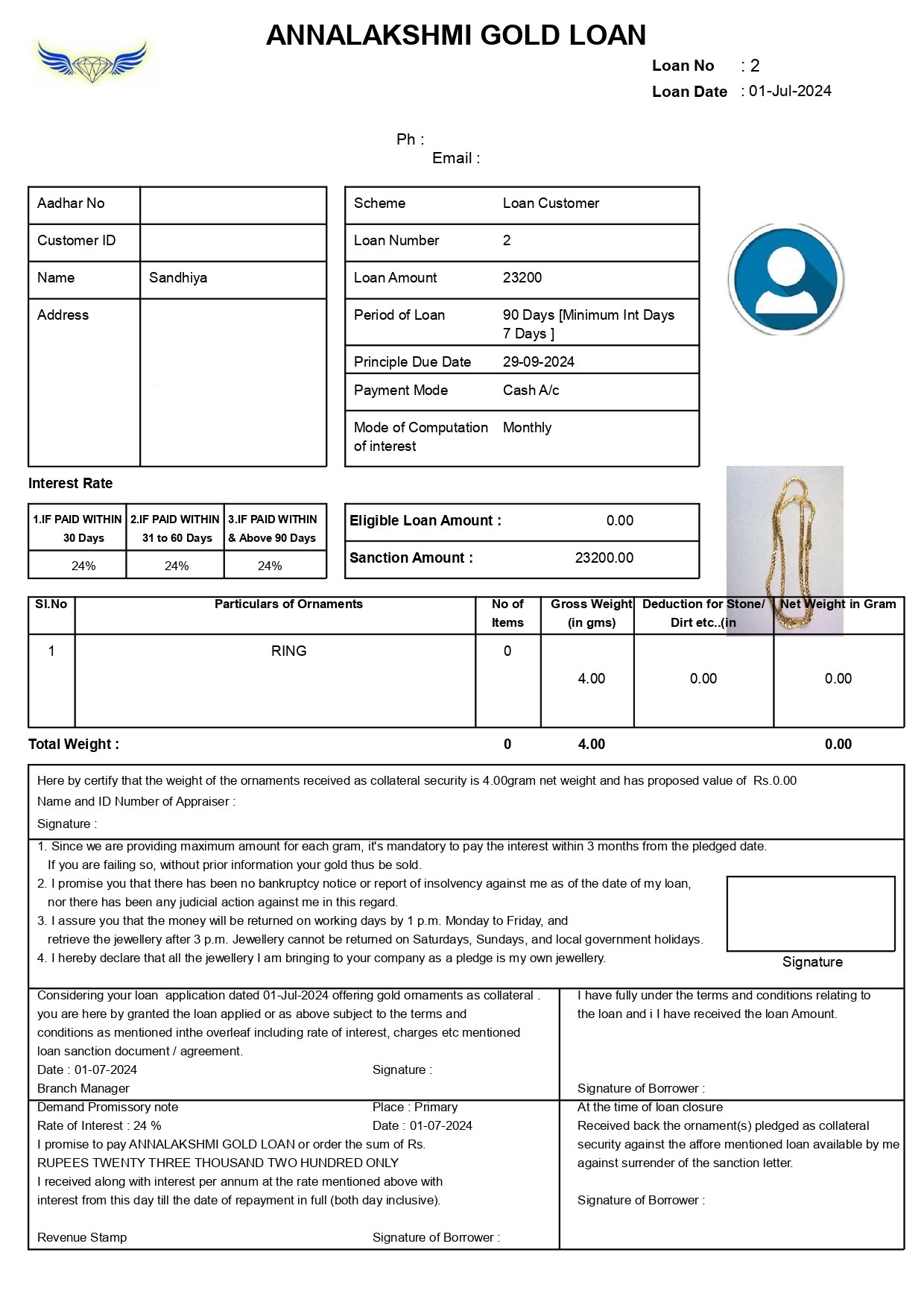

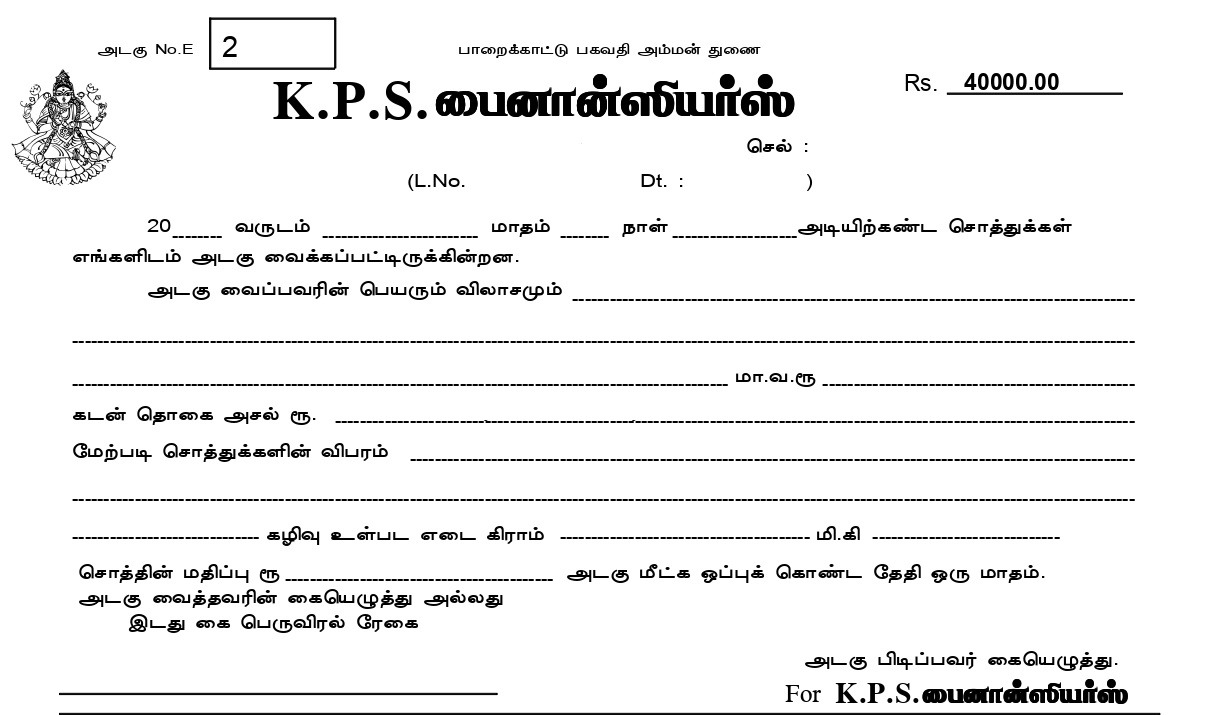

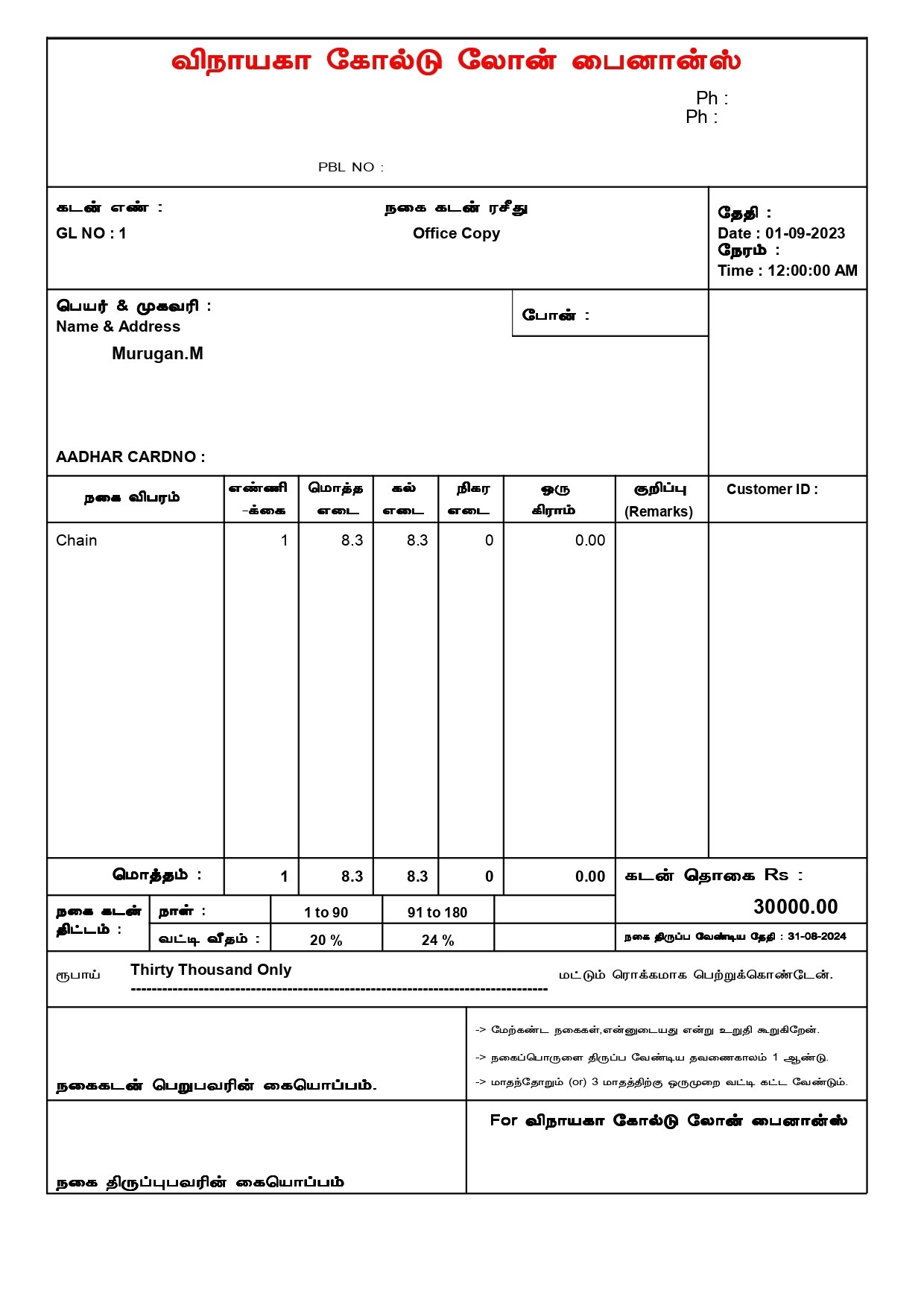

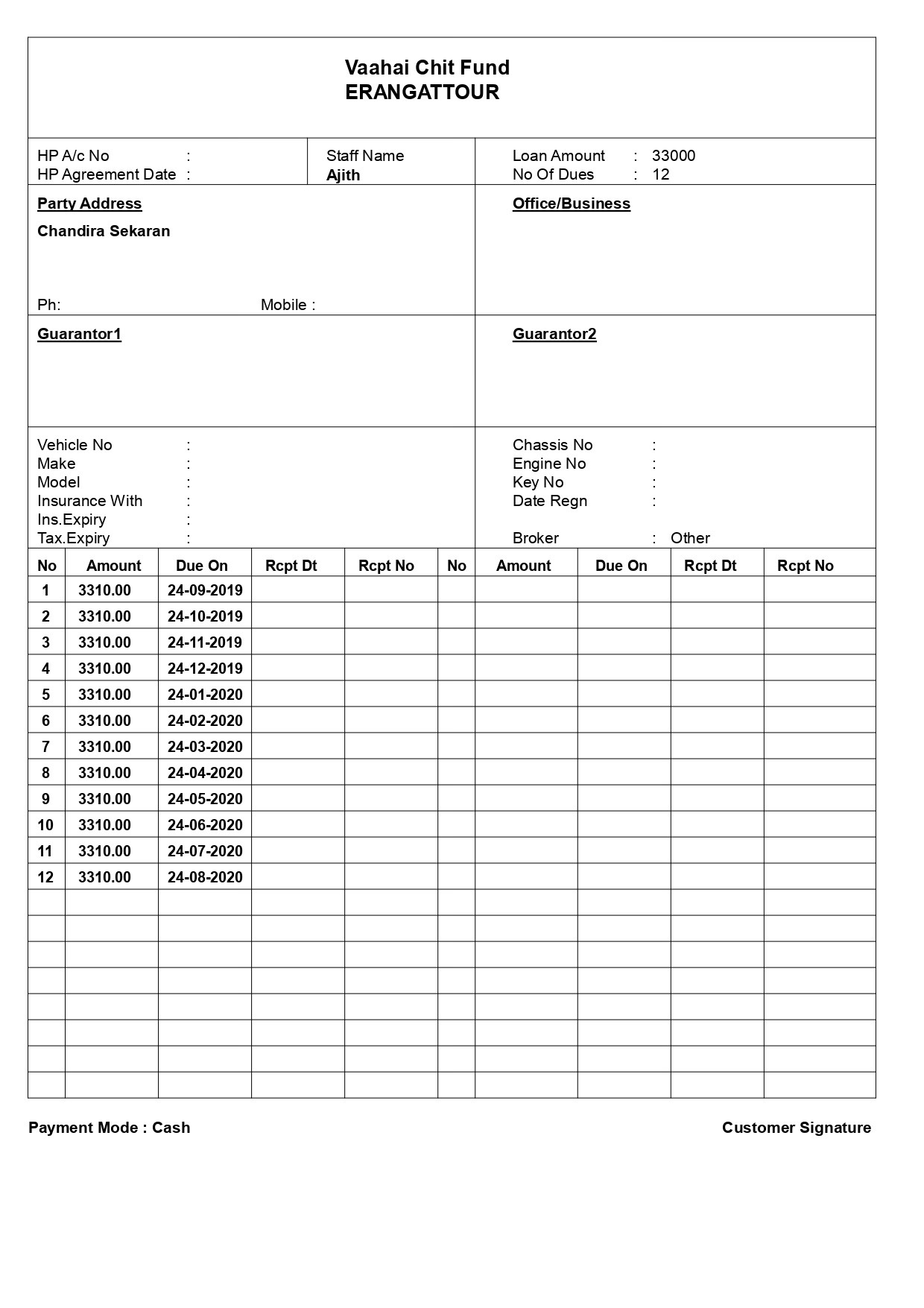

Management Software

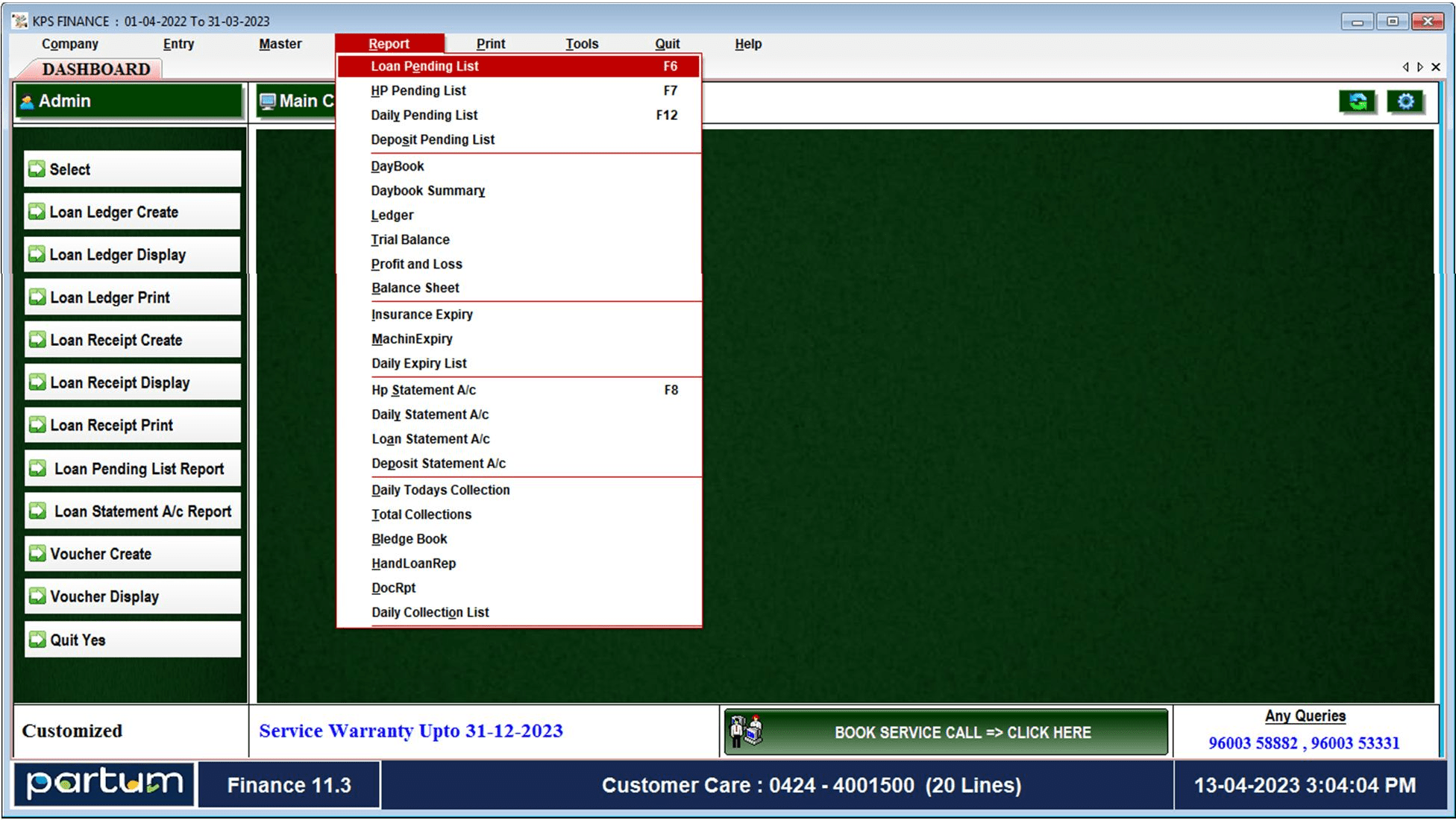

Finance management software is an essential tool for both businesses and individuals. Get to know your income, expenses, and net profit up close and personal. The Profit and Loss statement measures the financial health of your business by showing income and expense details. You don’t need to remember it all. This report does it for you! This report provides a detailed record of account transactions that matched software entries as well as outstanding transactions. We’ll save the details each time you reconcile your transactions in a handy PDF. Using our finance billing software, you can track expenses and income and generate reports for analysis. Select a timeframe (e.g., a month) to get started.

Account Reports

Day Book

Ledger Book

Trial Balance

Profit & Loss

Balance Sheet

Cash Book

Advantages

- Customized Dash Board

- Scheduled Auto Backup

- Menu Level User Control

- Tally Export

- Mobile Android App

Finance Reports

Integration

WEB SMS

WEB WhatsApp

Due Reminder

Receipt Message

FAQ

?What is Finance Management Software

What is a Profit and Loss statement?

?What are the top features of finance software

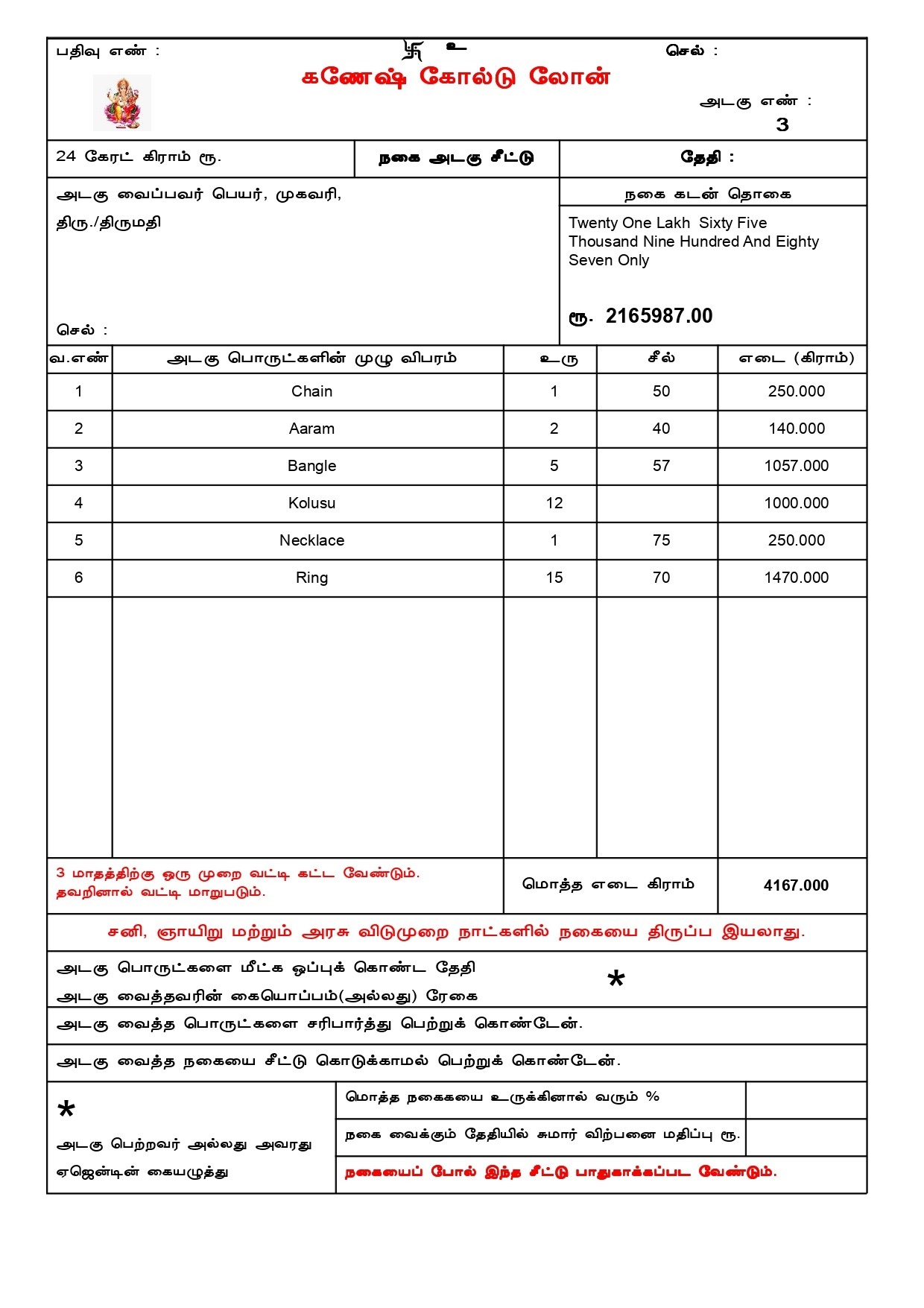

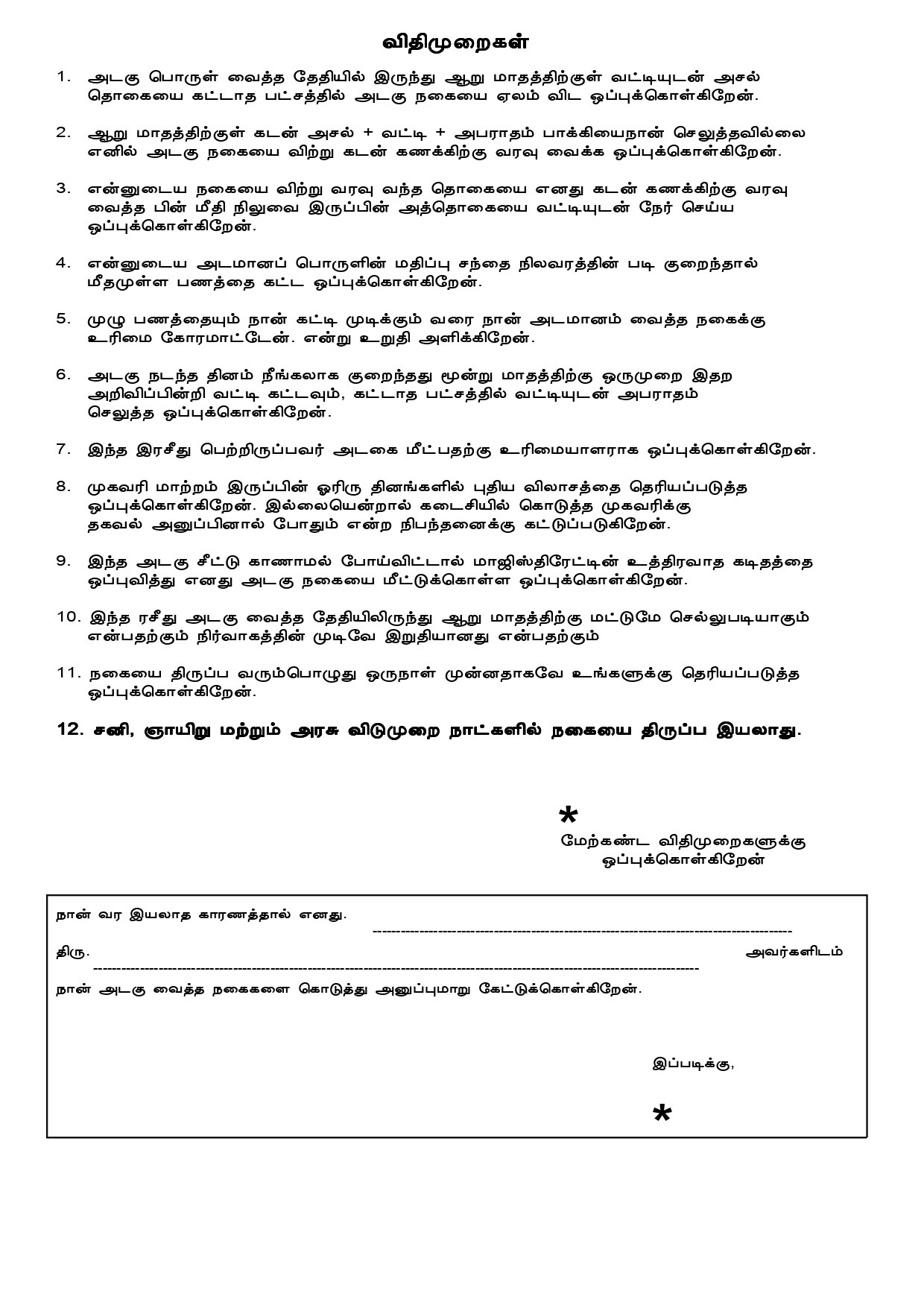

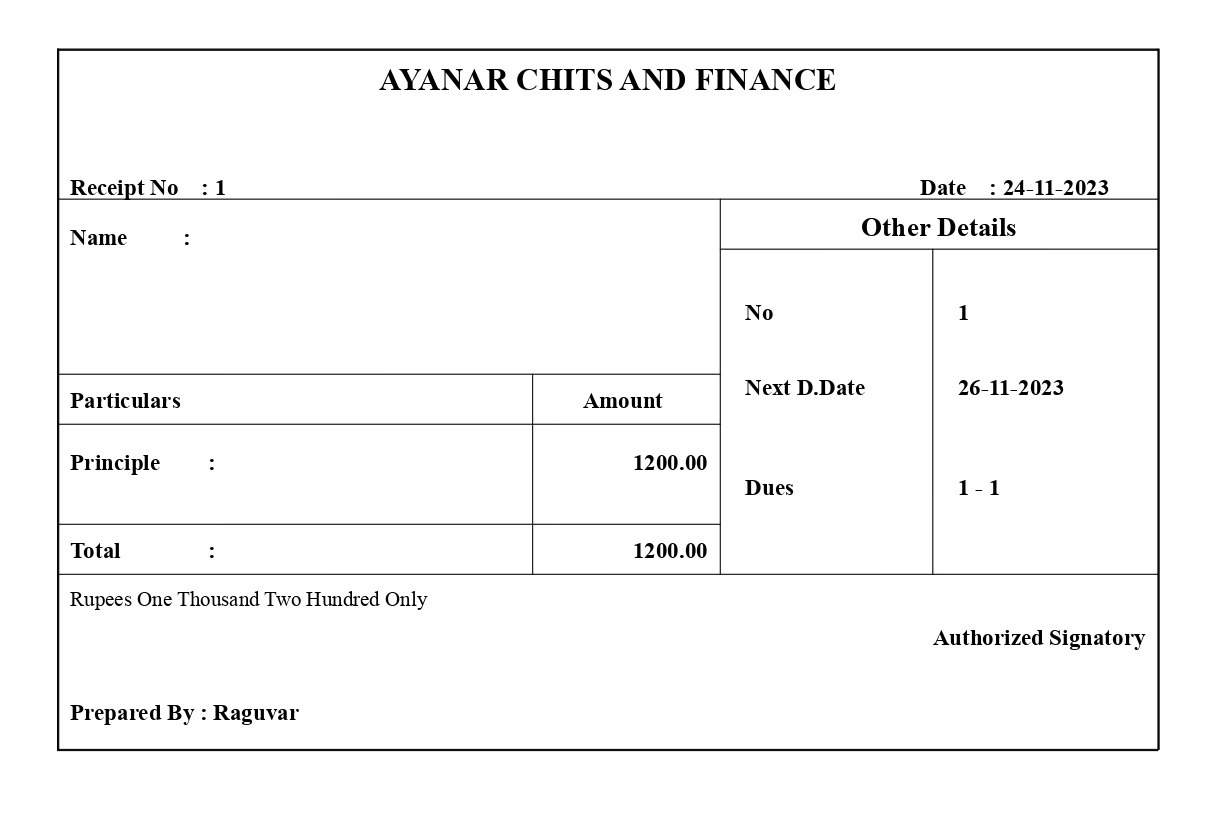

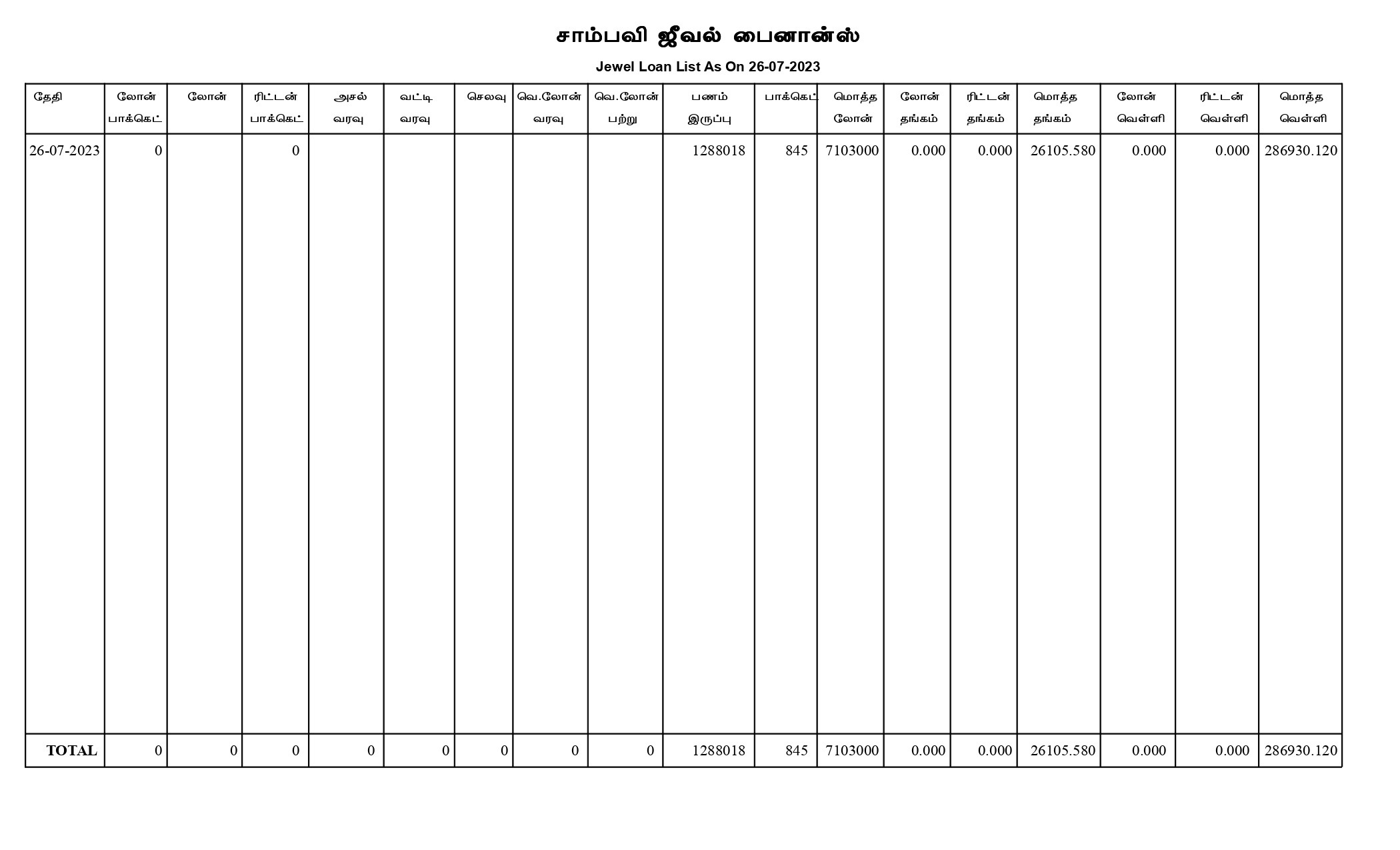

• HP, Loan, Deposit, Daily

• Party Statements

• Account Books

• Due Pending

• Tally Integration & 200+ reports